Blog

SEPA for the Western Balkans: Useful but not a game-changer

SEPA may well end up being one of the most consequential parts of the EU’s Growth Plan for the Western Balkans. But the EU could also do much more to bring more public and private capital into the region.

Amid the high-profile discussions surrounding the EU’s Growth Plan for the Western Balkans, one crucial aspect is the region’s invitation to join the Single Euro Payments Area (SEPA). While much attention has been given to broader economic and political integration efforts, SEPA membership could prove to be one of the most concrete outcomes of the Growth Plan.

The Single Euro Payments Area (SEPA) is an initiative of the EU aimed at simplifying euro-denominated bank transfers across participating countries. By harmonizing payment systems, SEPA makes financial transactions among its members cheaper, quicker and easier. For the Western Balkan countries joining SEPA represents a move to enhance financial integration with the EU, streamline cross-border payments, and bolster economic development.

As of March 2025, significant progress has been made by several Western Balkan countries in joining SEPA:

- * Montenegro and Albania: In November 2024, both countries became the first in the region to join SEPA, marking a milestone in their European integration efforts.

- * North Macedonia: In March 2025, North Macedonia was admitted into SEPA, further advancing its integration into European financial systems.

- * Serbia: The National Bank of Serbia had hoped for a positive decision on SEPA membership in March 2025. However, the European Payments Council (ECP) delayed the decision, requesting more progress on anti-money laundering and counter-terrorism laws.

- * Bosnia and Herzegovina and Kosovo: Both countries have expressed interest in joining SEPA and are actively working towards meeting the necessary requirements, though specific timelines for their accession have yet to be established.

Countries must first achieve regulatory alignment by harmonizing their national payment systems and legal frameworks with SEPA standards to ensure compliance with EU regulations governing payment services. Infrastructure modernization is also essential, requiring investments in technology and systems capable of handling standardized transactions to support SEPA payment schemes. Additionally, effective stakeholder coordination among central banks, financial institutions, and payment service providers is crucial for a smooth transition to SEPA-compliant operations. Finally, once the necessary criteria are met, countries submit their applications to the European Payments Council (EPC) for approval to officially join SEPA.

Modern payment systems, of which SEPA is a key example, have both domestic and international benefits. Domestically, benefits can include more financial inclusion and more payment products and services. Internationally, such systems can reduce the cost and time associated with international trade and capital flows (such as remittances). Membership leads to enhanced payment efficiency by enabling faster and more reliable cross-border euro transactions, benefiting both consumers and businesses. It also reduces transaction costs by standardizing payment systems, lowering fees associated with cross-border transfers, and making financial services more affordable. Additionally, SEPA integration improves financial infrastructure and strengthens ties with the EU's payment system. According to the World Bank, at present, the Western Balkan economies must pay six times more than their EU counterparts to settle international payments: If the six economies joined SEPA, the World Bank found that this would reduce the cost of sending remittances to the region, with the savings potentially totalling half a billion euros.

Benefits for the Western Balkans

SEPA could significantly boost trade and capital flows within the Western Balkans, thereby contributing to greater regional integration, a long-standing goal. Even more importantly, however, it will support trade and capital flows between the Western Balkans and the EU, which is the most significant way to boost economic development of the Western Balkans. While both regional and EU integration are important for the Western Balkans, the fact that the EU market is around 100 times the size of the Western Balkan six economies combined indicates where the greatest upside potential is.

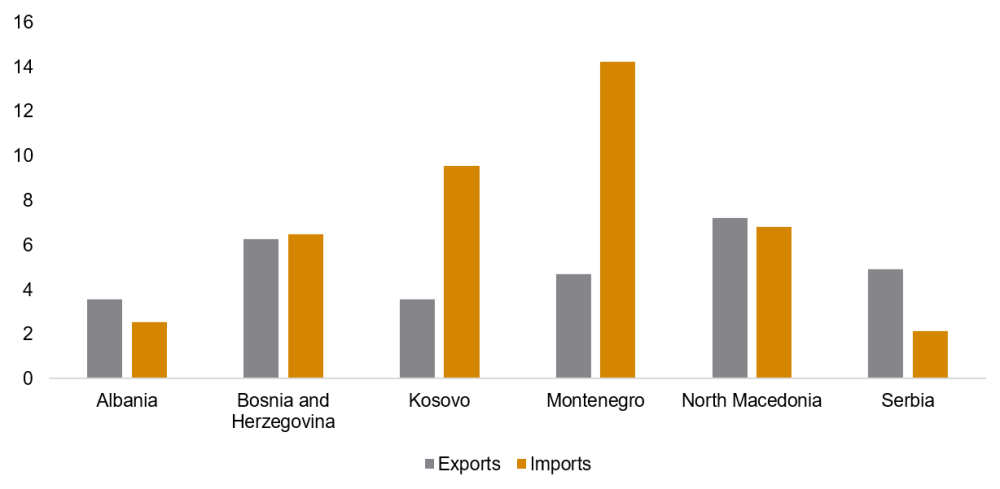

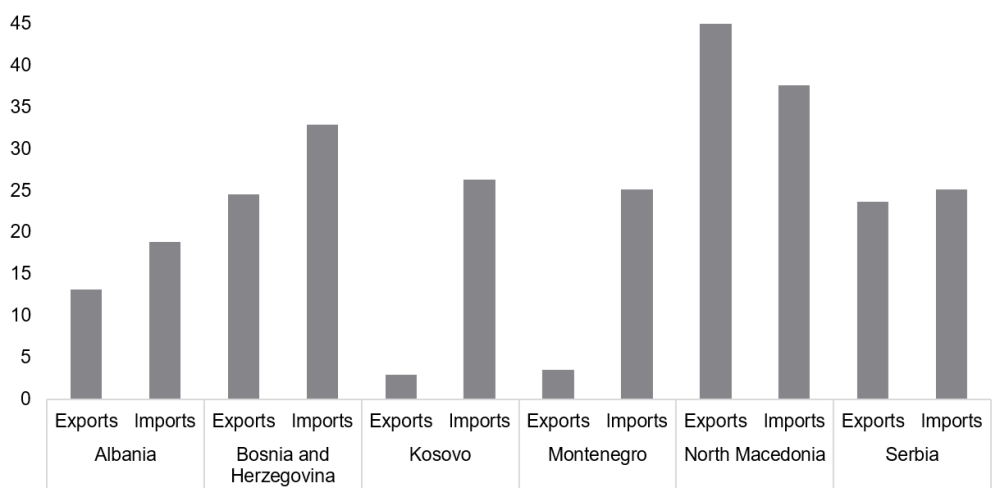

The amounts of trade and other capital flows that could be impacted by SEPA are significant, indicating that the impact of its introduction will have a noticeable positive impact. External trade with the rest of the Western Balkan countries accounts for between 6% of GDP in the case of Albania and 19% of GDP in the case of Montenegro (chart 1). With the EU the numbers are even more significant: from around 29% of GDP in the cases of Kosovo and Montenegro to 82.5% of GDP for North Macedonia (chart 2).

Chart 1: External trade in goods with the rest of the Western Balkans, % of GDP, 2023

Note: Serbia does not report trade with Kosovo as external trade. Sources: National sources, wiiw.

Chart 2: External trade in goods with the EU, % of GDP, 2023

Sources: National sources, wiiw.

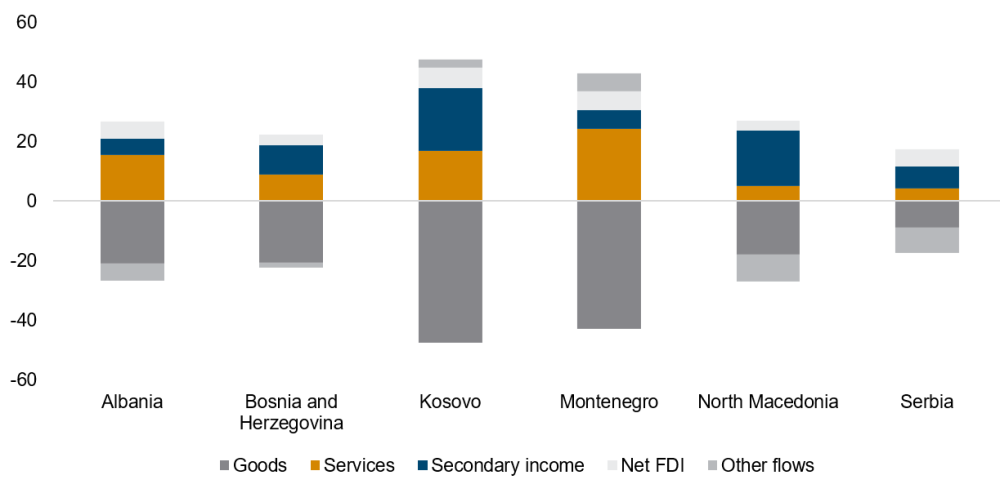

For many Western Balkan countries, however, the biggest impact of SEPA may not be felt in goods trade. Across the region, other international money flows, for example services payments (i.e. transport and tourism), remittances and foreign direct investment are in some cases even more important. Chart 3, showing a simple presentation of each country’s balance of payments, indicates the particular importance of certain components of international financial transactions for each Western Balkan country. All Western Balkan countries run substantial deficits in goods trade, from a shortfall of 8.8% of GDP in Serbia to 47.5% of GDP in Kosovo. All economies somewhat offset (or “finance”) this with trade in services, ranging from a surplus of 4.1% of GDP in Serbia to 24.2% in Montenegro reflecting the latter’s strength in tourism, although nowhere does the services surplus come close to offsetting the trade deficit.

Chart 3: Balance of payments, selected items, % of GDP, 2023

Sources: National sources, wiiw.

A big part of the difference is made up by so-called “secondary income” which is typically mostly remittances. Net flows of secondary income account for 21.1% of GDP in Kosovo and 18.5% in North Macedonia. The other really significant positive element of the overall balance of payments of Western Balkan countries is net FDI inflows, which account for between 3.3% of GDP in North Macedonia and 6.7% in Kosovo. (The “other flows” are different depending on the country but include the repatriated profits of foreign companies, which are especially relevant in North Macedonia and Serbia, and changes in central bank reserves). Western Balkan countries have been very successful at attracting FDI in recent years, at least relative to the size of the economy, although there are concerns about the quality and source of some of this money.

Taken together, the balance of payments indicate that all Western Balkan economies are “open” in an economic sense. All also run big trade deficits, which they finance via a combination of services exports (especially tourism), remittances and foreign direct investment. In all cases, the accession to SEPA would cut costs and transaction times, and feasibly support greater capital flows into the region. These flows should be carefully monitored to avoid financial instability. But if the financial flows continue to mostly arrive in the form of FDI and remittances, and if SEPA drives an increase in the latter in particular, this will benefit economic development and living standards in the region. SEPA may well also have the impact of reducing the share of money transfers that arrive informally in the region.

Financial liberalisation is not everything

While easing financial flows via SEPA will benefit the Western Balkans, it would be a mistake to hope that this alone will be a game-changer for the region. In a way, SEPA accession reinforces a long-standing focus on liberalising trade and capital flows between the Western Balkans and the EU. While this is important, without corresponding measures to bring more capital into the region, this approach risks further widening the Western Balkan trade deficits with the EU. Most Western Balkan countries already run huge trade deficits compared to EU-CEE (chart 4). The region’s underdevelopment does not stem primarily from difficulties in moving capital across borders, but from the chronic shortage of capital itself, both public and private, to finance the investments needed in production, infrastructure, and public services.

Chart 4: Trade balance, % of GDP, 2023

Sources: National sources, wiiw.

SEPA accession will therefore work best if combined with greater access for the Western Balkans to the EU budget, as well as EU support for industrial policy initiatives in the region which in turn could stimulate more and better quality FDI inflows. Reducing the frictions to the flows of capital between the EU and the Western Balkans is very welcome, but the EU could make a much bigger impact by finding ways to direct more public and private capital into the region in the first place. Full access to the EU budget—beyond the quite disappointing amounts included in the Growth Plan—would provide substantial funding for infrastructure projects, social programs, and institutional reforms. Meanwhile, to support industrial policy and greater FDI inflows, facilitated by SEPA, the EU can play a pivotal role by providing technical assistance and funding to implement smart specialization strategies, focusing on sectors like agri-food, textiles, automotive, energy, IT, and tourism. Such support would enable the Western Balkan countries to modernize industries and attract investment, helping to build export capacity and reduce the region’s large trade deficits.